Insurance – Life, Health and General

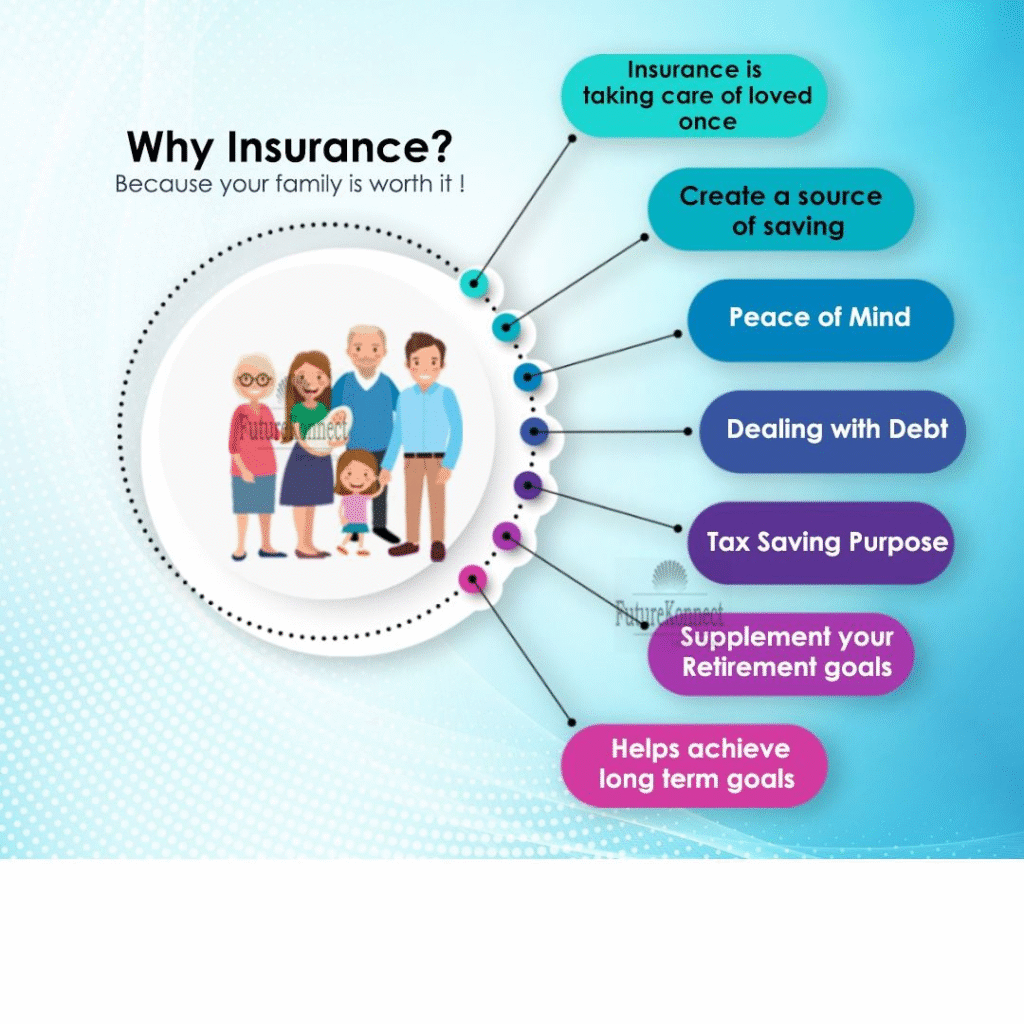

Insurance is an assurance policy that works as a contract between the insurer who receives the promise of indemnity from the insurer against losses.1

Life: Our everyday life is fraught with unforeseeable risks such as death, loss of income, critical illness, or disability. Pathik Ventures Pvt. Ltd., engaged in Insurance Planning so as to ensure adequate cover against “Insurable Risks” and to get the maximum out of your premium paid.

Health: Medical insurance must be taken for one’s self. The health-insurance policy shall ensure that the insurer will meet medical expenses of the insured as agreed between them and the insurer. Thus, the situation for any kind of medical emergency will be secured by the insurance. Therefore, a person does not have to worry about sudden medical expenses, as the insurer will pay for them.

General Insurance (Insurance for Assets, Personal Accidents, etc.)

General insurance protects your financial interests in the event of losses due to bad surprises in life and damages to the assets you value most. It protects you financially against threats pertaining to your property, car, personal accidents, health, and travel.

Knowledge shared and an infrastructure set up by Pathik Ventures Pvt. Ltd., will empower you to pick the best policy plan with all appropriate riders that exist in India. We provide after-sales service concerning claims and settlement, keep a watch on your policy terms and renewals, and many more